I may not have a formal degree in any finance-related course, but I don’t need any formal academic background to recognize the importance of managing my personal finances. In my opinion, you handle your personal finances properly if you:

- Create an ideal budget based on your total income

- Save funds for future needs and emergency situations

- Trace the transaction records and current amount of your financial resources.

Again this is just my two cents, the items I listed here are the stuff that worked for me based on my experience V(-_-)V.

With all the tasks above, you can be patient enough to use spreadsheets through MS Excel or Open Office Math. However, there are existing software applications that could be more ergonomic and robust in terms of features. The following apps listed below are some of the tools that you can use to aid you in your personal finance management. Please take note that you need not to use all the apps listed below. See the available features and sample user interface and see what do you think will work you, but then again, if you really want to go hardcore and use all of them, then by all means comfort yourself XD.

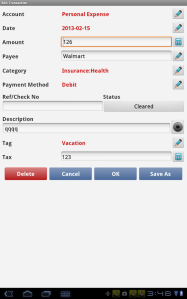

Expense Manager

Platform: Android

This app is pretty simple, but it covers the basic features essential for your personal finances. It records transactions for your income and expenses. Each transaction is created with a single entry. Each entry contains a lot of useful fields that could further describe your transaction:

- Account Name

- Date of Transaction

- Amount

- Payee

- Category (user defined)

- Payment Method

- Ref/Check No.

- Description

- Photo of Transaction (uses camera of the mobile device)

Account is summarized based on total current income and expenses. You can also create your budget based on a specific time interval (daily, weekly, monthly, yearly, one-time). Other than that, you can assign recurring income and expenses by specifying the schedule of the recurring transaction. The good thing about this application is that it runs on your Android device, so you can trace your finances on the fly since you always (or most of the time) carry your device wherever you go. The best part of all… it’s free.

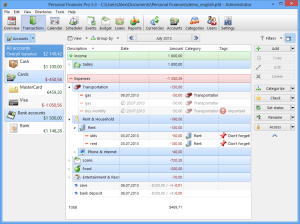

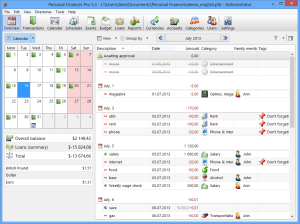

Personal Finances Pro

My favorite application so far. I’ve been using this for more than three years and it really served its purpose. Other than what Expense Manager can do, it also provides the following features:

- Transaction Calendar

- Loans

- Financial Report

- Currency Manager

- Budget Forecast

- Project File Password Security

- Family Member Profiles

The user interface is totally user-friendly. The project variables like accounts and categories come with a large list of icons which adds intuitive detail to your data. Reports contain the percentage of allocation for your income and expenses. You can filter the data based on categories, duration, and family members. You can also see the trends of your transactions which tell you from which category you usually earn and spend. The application also has a standalone version that you can use to install on your USB flash disk or any other external storage device. The data can be exported to a CSV or text file. The only catch is that the software is a paid application. However, they also have the freeware version that contains basic features you’ll need for personal finance data. I think this version will suffice if all you need to record is your personal cash flow :). Take a look at this comparison table to have a better idea of what you will get for free. Maybe if you earn enough, you can include buying the personal license for your next budget XD.

YNAB (You Need A Budget)

Platform: PC, MAC, iOS, Android

I found this software in an unexpected place… Steam. The platform widely known as a portal for video games also distributes software applications such as this. It’s a shame I wasn’t able to purchase this during the Steam sale. Anyway, this app almost has the same features as Personal Finances Pro, but YNAB promotes their product with a tie-up methodology which comprises of four steps:

- Rule 1: Give every dollar a job

- Assign a specific amount for each category. This way, you won’t look at your entire income as a whole when you’re planning to spend money on something but rather the allocation to the category where the purchase item belongs.

- Rule 2: Save for a rainy day

- Allot a budget for recurring, less-frequent expenses by separating the amount to monthly intervals. The funny thing is, I use this method long before I knew about YNAB. And I’m using Personal Finances Pro for this.

- Rule 3: Roll with the punches

- Be flexible when overspending. Adjust the allocations accordingly when such situations occur.

- Rule 4: Live on last month’s income

- You allot a budget for your next month’s expenses. YNABers call this the buffer. This is to give the user enough breathing room for paying the bills instead of timing it for the next paycheck.

Other than the software itself, the official website gives free online classes as well as blog posts for financial advices. Overall, YNAB doesn’t revolve with the tool, but it’s more of a comprehensive program to help you save more money and get more out of your financial resources. Though it’s not for free, the amount of cash that you will save (if you’ll be faithful to the program) will worth every penny that you spent.

Whichever you choose, keep in mind that the tool alone cannot help you handle your money properly. It takes discipline to avoid spending more than what you earn. It’s hard but if you focus on long-term gratification, you’ll see moving forward that all those plannings were totally worth it. I hope you find a tool and approach that will make you save more and in turn make you financially abundant. Cheers! (~^_^)~

Photo Credits: iTunes, Google Play, Steam